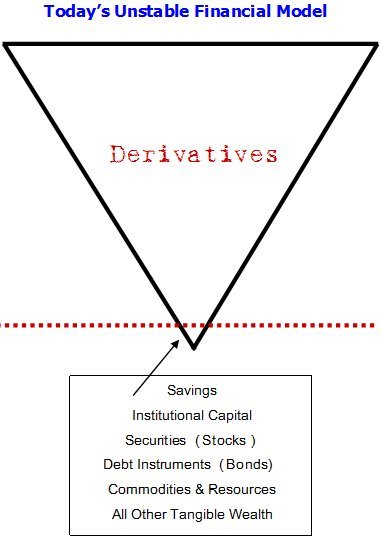

Thoughts? According to the Bank for International Settlements, the amount of derivatives is about 12 times the entire stock of capital in the world.

It’s an example of a good idea (risk transfer) taken to an extreme, gone bad. Like the reinsurance spirals of the 1980s.

This seems like it would be accurate considering that fractional reserve banking allows making loans on 1/10 of actual held assets.

The value of the underlying investments is what is at issue. Once they are bailed out the derivitive is back in the money and can be unwound and is no longer an issue.